Summary

Apple will report solid results for the June quarter, but media focus will be on guidance clues for the iPhone 8.

Ex-Googler compliments iPhone 7 camera.

Mostly positive reactions to Tesla Model 3.

Apple will report solid results for the June quarter, but media focus will be on guidance clues for the iPhone 8

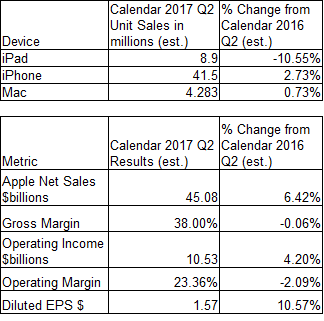

In a report I posted earlier for Rethink Technology subscribers, I gave my expectations for Apple’s (NASDAQ:AAPL) fiscal Q3 results. For purposes of this Tech Brief, I’ll be brief:

The predicted net revenue of $45.08 billion is slightly above analyst consensus of $44.89 billion and near the high end of Apple’s guidance range of $43.5-45.5 billion. Operating margin continues to decline as Apple adjusts to stronger price competition, which I’ve always argued should happen, given the company’s enormous profitability. I anticipate that Apple will continue to boost spending on R&D by about 13% y/y to $2.9 billion.

So Apple will post a slight revenue beat, but will meet expectations for EPS. I get the impression that no one will really care. All the attention is going to be focused on guidance for fiscal Q4, since this will speak to the rumors of a delayed launch for what is usually called the iPhone 8.

There have been innumerable rumors of production problems with the screen, the embedded Touch ID sensor, face recognition camera, and even last-minute design changes. The idea that Apple would be making design changes at this stage is particularly fatuous. Probably the iPhone’s design was frozen sometime around the beginning of the year. That’s how long it takes to get ready for an iPhone launch.

For a quick refresh, here’s the guidance supplied by Apple for its third fiscal quarter of 2017:

- Revenue between $43.5 billion and $45.5 billion

- Gross margin between 37.5 percent and 38.5 percent

- Operating expenses between $6.6 billion and $6.7 billion

- Other income/(expense) of $450 million

- Tax rate of 25.5 percent

Be the first to comment on "Apple: Is The Media Too Obsessed With The iPhone 8?"