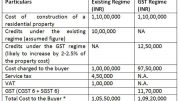

The Cabinet has approved the increase in the rate of cess levied on luxury cars and SUVs from 15% to 25%. Under the GST regime, large cars with engine capacity of greater than 1,500 cc and SUVs with a length of more than four metres and engine greater than 1,500 cc attracted a cess of 15 per cent in addition to the top tax rate of 28 per cent. The overall tax incidence on locally-assembled luxury cars had come down from around 55 per cent earlier to 43 per cent in the GST regime. The additional cess on luxury cars and SUVs will now bring the total tax figure on these cars at 53%.

GST:

Almost all carmakers had updated their price lists after GST brought into effect. The argument against the previous set up was that some believed the revised tax rate only benefited the rich since luxury cars witnessed a large dip in prices but small to medium cars remained largely unaffected. In order to rectify the situation, the government came up with additional cess on cars with over 1500cc engines and more than four metres of length.

What’s worse is that since cars over four metres and with over 1.5-litre engines will included in this tax hike, it means that cars like Hyundai Verna, Honda City, Mahindra Scorpio, Maruti Suzuki Ciaz and others which aren’t exactly a part of the luxury segment, will also affected.

So, what has happened now essentially is that cars that don’t fall into the ‘small car’ category will see a price hike as the GST Council has officially revised the rates. A long list of popular cars will see a price hike, including the likes of Jeep Compass which we all thought so brilliantly priced at Rs 14.95 lakh.

Be the first to comment on "Luxury cars, SUVs to become costlier as govt hikes cess from 15% to 25%"